How to make $500,000 with your TFSA

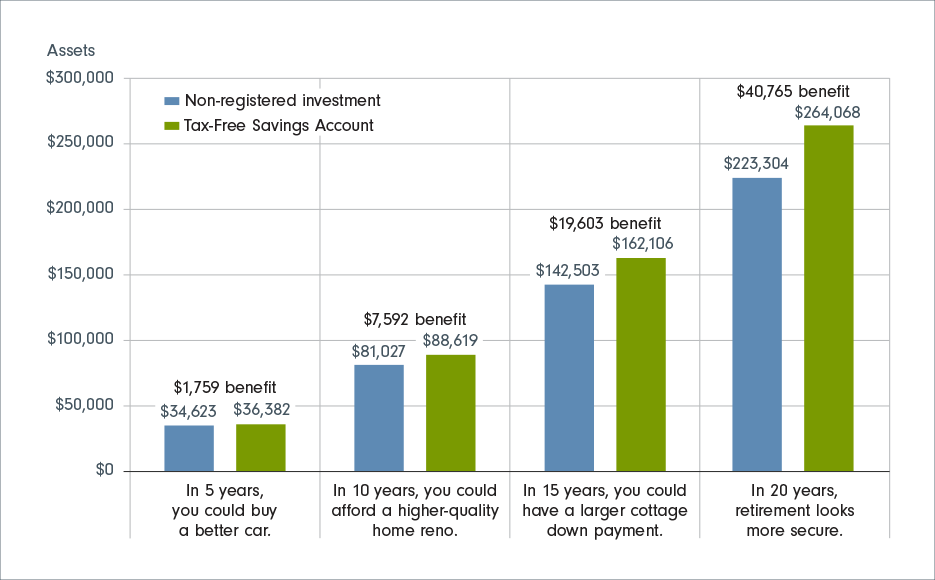

I make no exaggeration in saying that the Tax Free Savings Account (TFSA) will be the single most valuable savings tool for many Canadians. If used properly it can generate you nearly $500,000 in tax free investment returns and provide you $45,000/year over a 25 year retirement (not including CPP and OAS benefits).

Slow and Steady

The average Canadian full-time income in 2020 was $54,630/year meaning if you directed 10.9% of your income and maxed out your TFSA each year ($6,000/year) for 30 years you would have contributed $180,000 in total but due to the power of compounding growth on your investments would be valued at ~$660,000!

Because there is no "tax drag" on a TFSA you get the full compounding growth:

There is a catch!

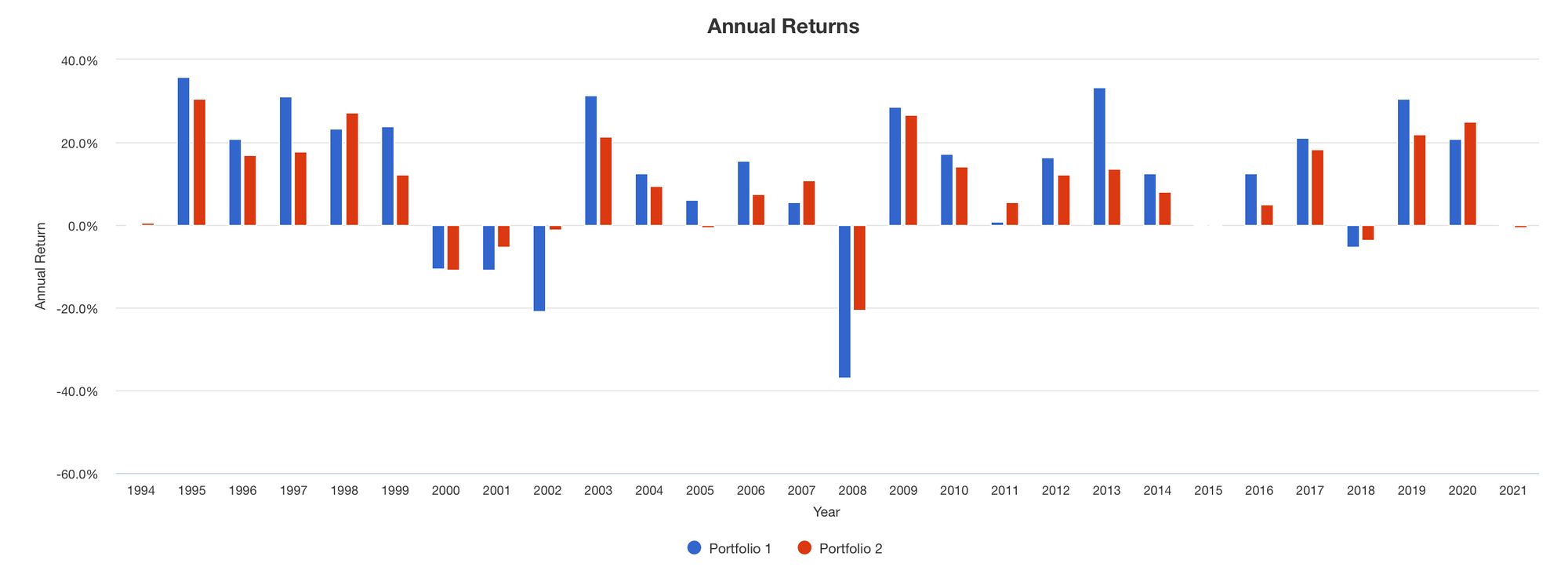

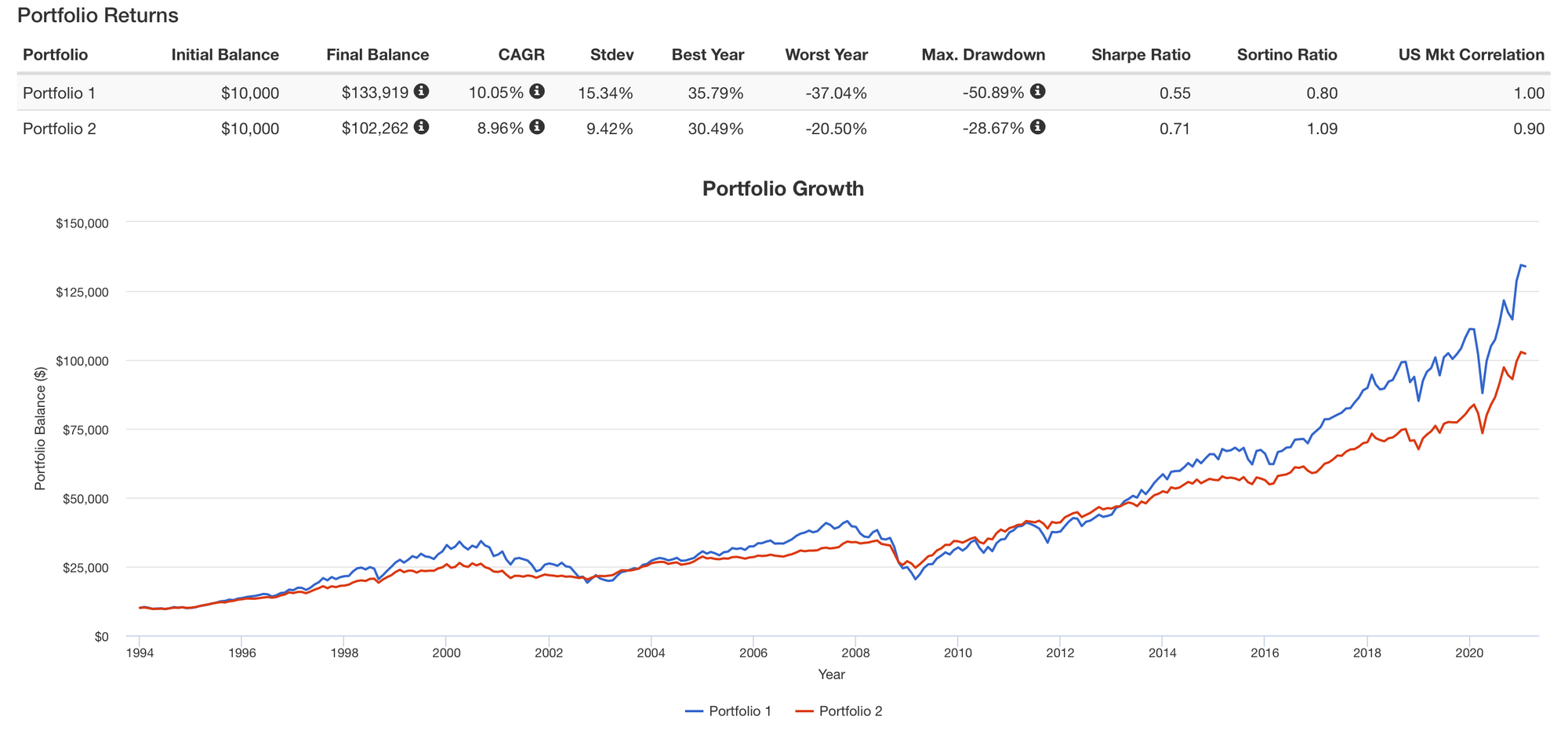

In order to see compounding growth of this size you need to start contributing early, contribute consistently, and leverage growth investments. Investing with a long horizon can have some inherent volatility but your returns on average will be significantly higher and you should be comfortable with the associated ups and downs you will experience.

As you can see the conservative portfolio had less volitility but resulted in $30,000 less growth.

How to invest your TFSA for the long term

The easiest way to accomplish this is purchasing an “All-in-one” index fund that has a high ratio of equities to bonds, good options include VEQT, XEQT, VGRO, or XGRO. If you want a full guide of how to invest your TFSA check out this article.

Once you have your investments setup in your TFSA your basically done, at this point you just need to be mindful of your savings obligations and make sure to put money aside for your TFSA each year when you eligible to deposit more!