Lifecycle Investing: Leveraged Passive Investing

As I was researching how you could use leverage with a passive investing strategy I found the book "Lifecycle Investing" by Ian Aryes and Barry Nalebuff. It details how using leverage can actually reduce your portfolio risk while improving your chance of retiring successfully. I read through it and wanted to document my takeaways aswell as who I think should pick up this book.

What is leverage?

Leverage is using borrowed funds to increase the value of your position while also increasing volitility. Used correctly it can multiply your investment return both positively and negatively.

A common example of leveraged investing is a mortgage, you're using borrowed money to invest in a house which can either appreciate or depreciate. If you bought a $500,000 house with a 10% downpayment you are leveraged 10:1, for every 1% the house goes up/down in value your initial investment goes up/down 10%.

Temporal Diversification

The book introduces the idea of "Temporal Diversification" (TD) which involves using leverage to own more stocks early in your investing phase which will capitalize on your long time horizon and ability to ride out short term volatility and should result in higher expected returns. TD also means as you get closer to retirement you lean more heavily into fixed income investments to protect your nest egg as you approach retirement.

Types of Leverage

Barry and Ian talk about several effective sources of leverage but there are 2 that Ill highlight:

- Cheap margin. Margin is using your investments as collatoral to borrow more money, if you have $10,000 invested your brokerage may offer you "margin" which allows you to borrow (in some cases) up to $10,000 for a fee. At the time of writing this brokers like IBKR offer margin at ~2% before the tax decuction so effectively 1-1.5% effective cost.

- Call options. Specifically deep in the money call options. This option might be a little more foreign but call options provide you the "option" to buy a stock for a certain price for a period of time. For example if FOO is trading at $100 and you pay $50 for a FOO call option at $50 you are now leveraged 2:1.

If you had $5000 and FOO was trading at $100 you could:

a. Buy 50 shares of FOO

b. Buy a call option for 100 shares of FOO at $50

In case "a" if FOO goes up/down by $1 you make/lose $100 but in case "b" for every $1 FOO goes up/down you make/lose $200, 2:1 leverage.

Doing the Math

If your still interested in this strategy then you should probably check out the book. They have several sections dedicated to backtesting and comparing how your portfolio would perform compared to a non-leveraged portfolio and it all seems to point toward this strategy increasing short term volatility but having more favorable long term outcomes.

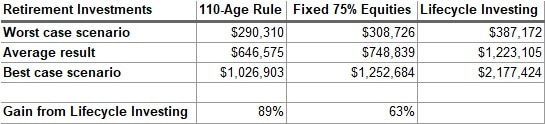

The below chart compares "birthday investing", fixed 25/75 bonds to stocks, and their temporally diversified portfolio:

From backtesting this allocation strategy seems better in every way.

Should you checkout this book?

Using leverage is a deeply personal choice and before you explore it you should check out this list to ensure there isnt any other optimizations your missing out on first.

I dont know if I would recommend everyone runs out and buys this book as it's meant for folks that have maxed out their registered investment accounts but being raised in Canada I know there is a distain for nearly all forms of debt (except for mortgages?) that is widely accepted, this book is a good introduction to how investment loans might be good. If its at your local library, can borrow it from a friend, or find it on sale its something I would recommend atleast skimming and seeing what you can learn about leverage.

Will I Lifecycle Invest?

This strategy can benefit anyones portfolio but it seems most adventageous for young people, in mid to high tax brackets, that are investing outside of registered accounts. I am lucky enough to fit these criteria and will likely explore implementing some of the suggestions they have to become "temporally diversified" but I may be bias as I was already searching for ways to use leverage with my portfolio.

Personally I will be leveraging my home equity to increase my unregistered investments and using cheap margin (IBKR) to gain a small amount of leverage in my existing unregistered accounts (5:6 or 20% leveraged). While I cannot use call options cause their arent any for the index's I already invest in and even if I do change my portfolio composition, margin has a tax advantage as you can perform tax loss harvesting and hold investments for decades until your in a low tax bracket to realize your gains.