Avoid minimum balances

Most big banks have fees but the reality is that many will waive those fees if you keep a minimum balance in the account, while this sounds like a deal you may be better off paying the fee!

For a free $20 sign-up bonus and the best HISA in Cananda (IMO) use my referral link for EQBank! It also helps support me writing this blog!

I wrote an article about how you can get your tax refund early and save yourself tens of thousands of dollars, while exploring that I also found a similar optimization with picking your bank!

Accounts with Monthly Fees

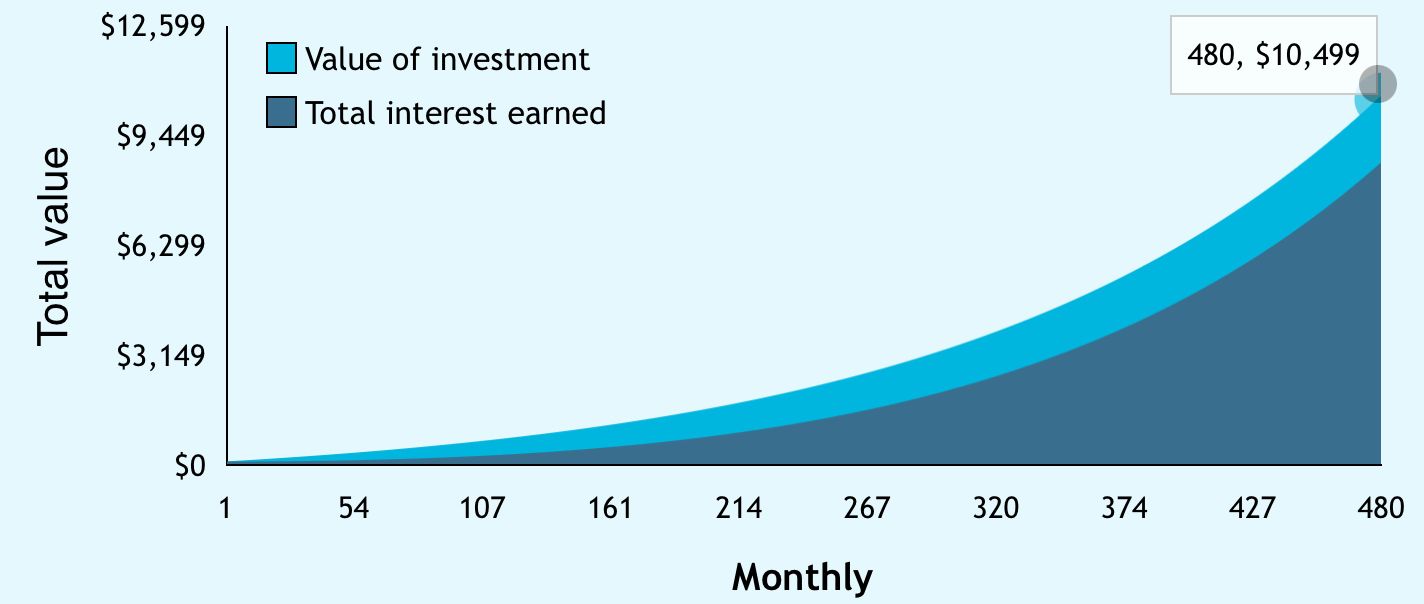

Lets assume you pay a monthly fee of $4/month, if you instead put that money into a growth investment account over 40 years you would have over $10,000

While the "actual" cost is $4/month or $48/year when you consider the opportunity cost its closer to $22/month or $260/year.

Accounts with Minimum balance

So you might think that this changes if banks waive these fees for maintaining a minimum balance, but that usually isnt the case. Your minimum balance usually sits in a chequings account which makes virtually 0% interest, that creates an opportunity cost. Right now there are multiple banks that offer interest rates between 1.25%-1.55% so if you had a minimum balance of $4000 that creates a monthly opportunity cost up to $5.15 so even after income tax (bank interest is taxed as income) your looking at ~$4/month and the same $10,000 over 40 years.

Keeping a minimum balance could even be worse then a fee if you rely on the minimum balance cause often dipping below this balance for just 1 day in a month and the bank will not waive the fee, this disproportionately effects those who dont have reliable income and get hit with fees at the worst times.

Solution

Between Tangerine and EQBank I have 99% of the features a Big Bank offers for $0 a month. That being said there have been times I've needed a Big bank, for example when I bought my house I needed a bank draft within 3 business days which is too short notice for Tangerine. I was able to open an account at a Big Bank, transfer money over, get a bank draft, and close the account for $4.

Thankfully most Canadians have great free banking options (you and find some of them here) that have competitive interest rates, no minimum balance, and no fees. Ultimately it is up to you if the opportunity cost is worth the value that your Big Bank provides you, if your a person that frequently deposits/withdraws cash, makes use of the physical branch, or simply want all your accounts in one place; just make sure that your aware of what your paying.