Self-directed Investing in 5 steps

DIY is one of the best ways to save money, changing your own oil, bagged lunches, mowing your lawn, shoveling your laneway; but self directed investing will save more than pretty much any of these things combined. A few hours of work can result in hundreds of thousands of dollars in savings and improve quality of life in retirement.

What is Self-directed and Passive Investing

Self-directed investing is when a retail investor chooses the assets for their investment portfolio.

Passive investing; the opposite of stock picking. Passive investors purchase index funds and ETFs to own a spread of the whole market rather then a handful of specific companies.

Cost of investment managment services

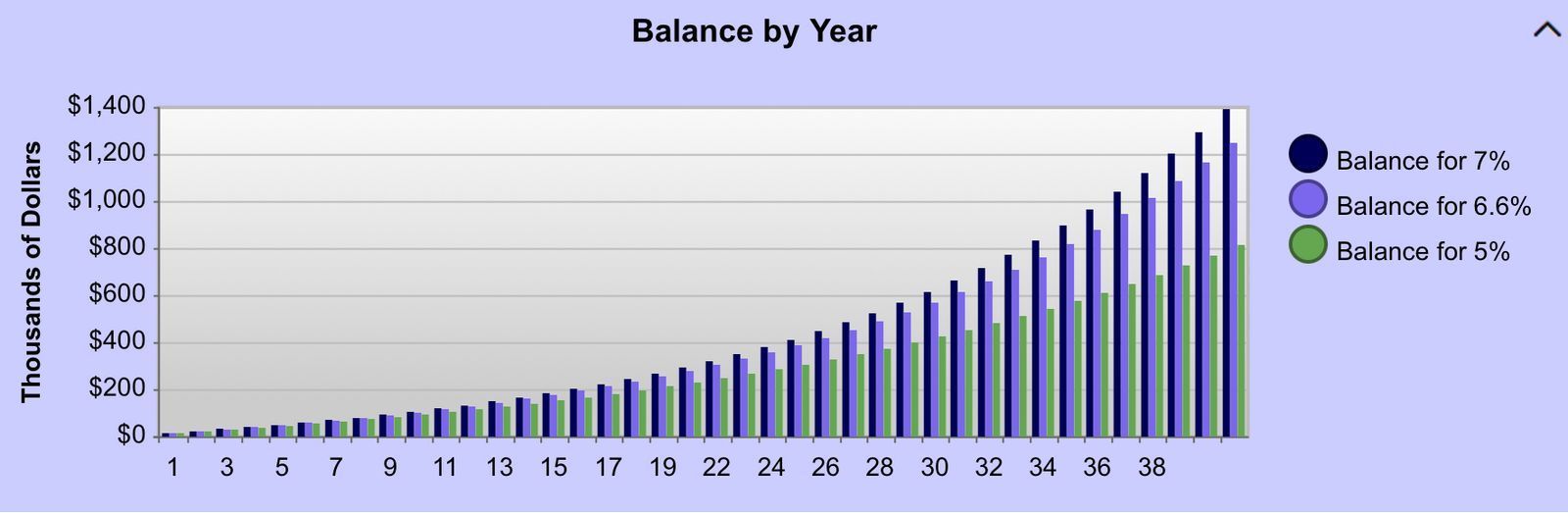

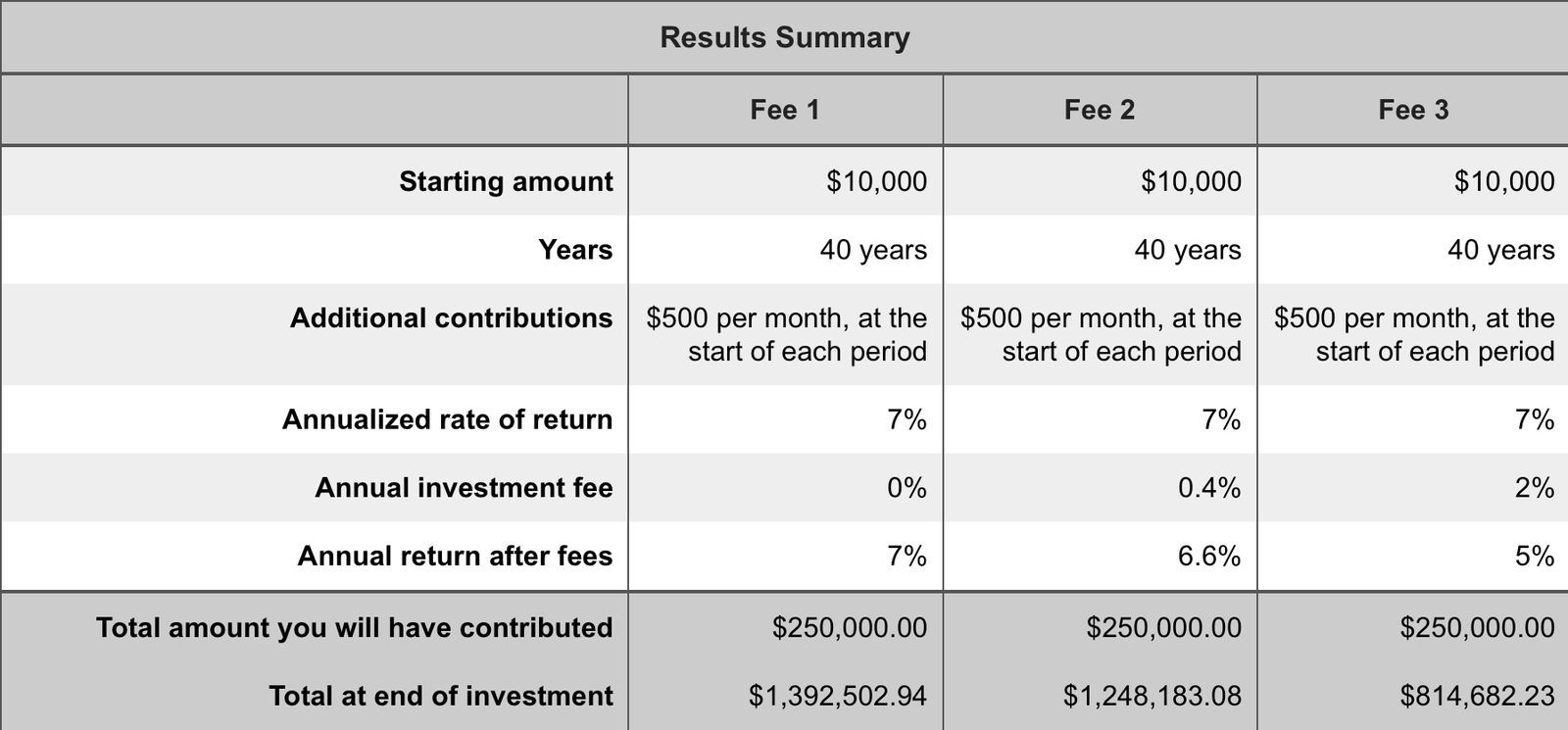

Robo-adisors, mutual funds, and portfolio managers all have fees that range from 0.25-2% (not including MER and transaction costs of the specific funds), compared to 0% for self directed investing.

Investing $6,000/year over 40 years results in fees ranging from $145,000 - $500,000 when comparing self-directed, robo-advisors, and traditional brokerages. Thats alot of oil changes and bagged lunches.

Step 1: Sign up for low fee brokerage

The bad news is that Canada doesnt have alot of options for brokerages but the good news is there is a few really competitive ones. This includes Questrade, IBKR, QTrade, and Wealthsimple Trade.

Personally I use and recommend Questrade cause its $0 fees for ETFs, supports many currencies, and integrates with tools like Passiv that can automate alot of tasks for you. Sign up for Questrade with my referral link using my "QPass key: 635611804438276" and you will get between $25 and $250 when you open an account (and support this blog!).

Step 2: Transfer your accounts to new brokerage

If you have a TFSA/RRSP account you should now transfer it to Questrade, this process is very simple. Log into the Questrade account you made in step 1, select "transfer an account to questrade", provide your account details, and initiate a "in cash" transfer. Now this will sell any investments you have in the account and transfer the cash value over to Questrade. Your account transfers will take a few weeks to complete, during this time you should begin step 3.

If you have an "unregistered" account you should also transfer this over but be mindful of the tax implications of transfering in-kind vs in-cash, this isnt relavant for TFSA or RRSP transfers.

Step 3: Setup your portfolio distribution

Warning: This step will likely feel the most daunting but once its done you wont need to change it for a decade or more. You got this!!!

Sign up for a Passiv account (referral link). Passiv allows you to setup a passive investment portfolio and will automatically notify you and rebalance your accounts when they deviate from your target.

After you signup for Passiv and link your Questrade account you will get their "Elite" subscription for free which allows you to rebalance with a single button click.

I've written an article on how you can choose the portfolio thats right for you:

All of the options in the above article are extremely well diversified and I would recommend any of them. You should take some time to think about what distribution is best for you, the company doesnt really matter that much.

Once you have picked a distribution you can either make a portfolio like this or using the power of Passiv you can reduce the MER you pay further by purchasing the underlying funds.

You can find my model portfolio here. Im a 25 year old Canadian with a long investment horizon so I have picked VEQT as my model because its 100% equities (so a higher expected return in the long run) and its relatively high amount of Canadian investments (~30% Canada and ~40% US).

Step 4: Setup auto deposits

I know you might be suffering from decision fatigue but you only have 1 more thing to decide, how frequently do you want to contribute to your accounts?

You can fund your Questrade account quickly and easily through your banks "online bill payments" function, once you setup Questrade as a "payee" in your bank (like you would pay student loans, utilities, credit card) you can setup automatic deposits that fit your budget on a recurring basis.

If you bank doesnt support recurring bill payments definitely consider switching to a better bank, check out my recommendations here.

If you would prefer you can also setup "pre-authorized debits" (PAD) from Questrade but IMO bill payments are much easier and can be initialized and canceled from your bank.

Step 5: Rebalancing

Now everything is almost completely hands off. Passiv will send you a email whenever your portfolio drifts too far from the target you setup in Step 3, when these emails come in you simply log into Passiv and click the "rebalance" button!