Wealthsimple vs Questrade 2021

In the world of retail investing and saving, Wealthsimple and Questrade have poured millions of dollars into advertising this past year to get you thinking about them. They advertise their robo-advisors, low fees, and better returns than the big banks but which of them is better?

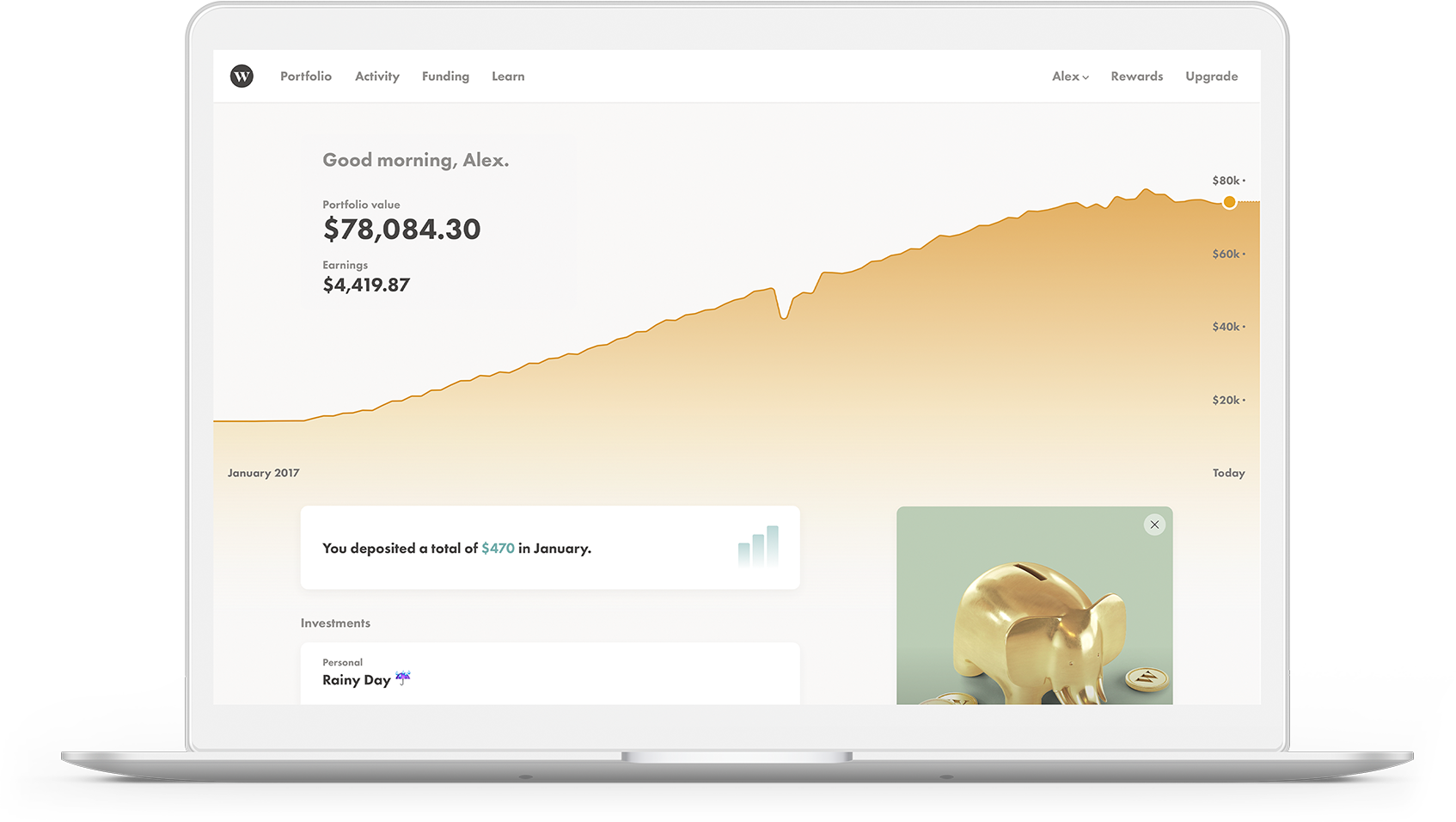

Wealthsimple Trade and Invest

There are 2 primary products that are offered by Wealthsimple:

Trade: WS Trade is a product that allows you to buy and sell stocks and index funds directly with zero fees on Canadian listed securities and a 1.5% FX fee if you purchase US listed securities and DOES NOT support holding currencies other than CAD, does not support options trading, and does not support investing with margin.

Invest: WS Invest is their robo advisor which will ask you a series of questions and assign you a level of "risk". Any money that you transfer in will be automatically invested based on your level of risk and you will pay a fee of 0.4-0.5% annually to Wealthsimple.

Both the "Trade" and "Invest" support registered accounts like TFSAs, RRSPs, and RESPs. Neither product supports margin investing or options trading.

Questrade and QuestWealth

Questrade also has 2 products:

Questrade: This is a fully featured retail investing product. It supports investing with margin, trading options, and holding foreign currencies and securities. There are fees with range from $0.01/share with index funds to $4.99 per trade with blue chip stocks. Questrade also has a fantastic developer api which allows services like Passiv to help automate your investing.

Questwealth: This is Questrades own robo-advisor product which will automatically invest any money you deposited and has fees between 0.2-0.25% annually.

Which one is best?

The answer is based on 2 truths:

- Time in the market is king!

- The cost of switching is low

Given these 2 truths you should pick whatever product your comfortable investing with today and over 3/6/12 months if you decide you want to move from WS Invest -> WS Trade -> Questwealth -> Questrade -> WS Invest the total cost is relatively low compared to the cost of delaying investing your money, while you should avoid too many platform switches its best to setup something today and switch next month then to wait until next month to take the furst step. Neither Questrade or Wealthsimple charge fees to open/close an account so the cost moving your funds from one to another is very low.

Which one should I use?

Everyones situation is different but I think there is 3 broad types of people:

- Never invested with a TFSA or RRSP

Just sign up with Wealthsimple Invest and your first $10,000 will be fee-less for a year. Take that time to look into "self directed investing" and as you make regular contributions you can decide if you want to move to a "cheaper" platform like Questwealth or Questrade/WS Trade. - Invested with TFSA or RRSP but no "unregistered" investing

Transfer your accounts to Questwealth and they will rebate you any fees. The fees for Questwealth is less compared to Wealthsimple and it will make it easier to move to a self directed portfolio in the future if you decide you want to go that way for even less fees. - Currently investing using TFSA or RRSP and have "unregistered" investments

Questrade. If your into unregistered investments your total assets are likely sizable enough that the fees are small enough that the functionality it offers is more valuable to you in the long run.

How do I learn about "self directed investing"?

Check out this "personal finance canada guide" and the other articles on this site here!