What is a TFSA?

If your a Canadian that is 18 years of age or older your most important investment vehicle is the “Tax Free Savings Account” or TFSA for short. As the name implies this registered account allows you to deposit money and invest it completely tax free which can save you hundreds of thousands of dollars by the time you retire.

Who gets a TFSA?

Any Canadian who is 18 years old and spent more then 6 months of the calendar year in Canada will get that years worth of “contribution room”. This room can be used however you like.

How do you get contribution room?

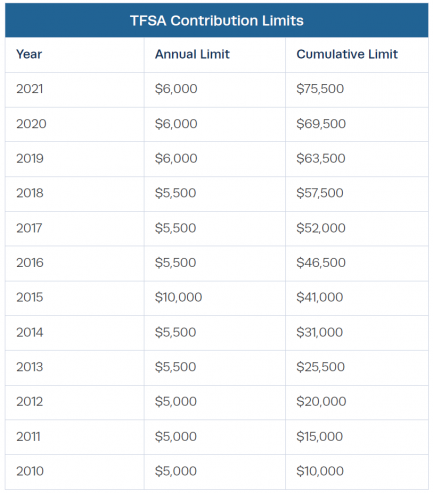

You can check this page for the historical amounts but as of 2019 every qualifying Canadian receives $6,000 in new contribution room on January 1st, this amount is pinned to inflation and rounded to the nearest $500 increment so it will increase every few years.

For example:

- If you turned 18 or moved to Canada this year you will have $6,000 of contribution room.

- If you turned 18 or moved to Canada in 2018 you would have $23,500 in contribution room. $6,000 for 2019/2020/2021 and $5,500 for 2018.

- If you turned 18 in 2018 and began living abroad in 2019 but came back to work in Canada in march of 2020 because of COVID you would have $17,500 in contribution room because you are not eligible for the $6,000 in 2019 but you would get $5,500 from 2018, $6,000 from 2020 and 2021.

How do you open a TFSA?

So now that you know what the TFSA is, how do you open one? Pretty much any Canadian bank or investment broker will be able to open a TFSA in your name and you can begin making contributions. Check out this article to compare which institutions are best to open your TFSA.

How to invest in your TFSA?

Picking what to invest in is a deeply personal decision and depends greatly on your own risk tolerance. That being said I have an article here where we review some of the most popular options for investing in a TFSA.

How do you withdraw from a TFSA?

So once you put your money in and have it grow for some amount of time you may end up needing to withdraw the money. Withdrawing from your TFSA unlike the RRSP and RESP has no tax implications, this means you just withdraw the money and spend it however you want.