What is an RRSP?

If you Canadian the “Registered Retirement Savings Plan” RRSP is a vital investment vehicle, while it may not be quite as valuable as your TFSA it can reduce the amount of taxes you pay and increase your savings in retirement if used properly.

Why use an RRSP?

The RRSP allows you to “defer” paying taxes until a future year. By depositing $1000 into your RRSP you are allowed to claim a $1000 deduction on your income tax which will result in a tax refund, this is particularly valuable if you are in a moderate or high income tax bracket.

For example in 2020 if you make $50,000 in Ontario you will pay ~22% to the CRA in federal/provincial income tax and you will be at a marginal rate of 29%. If you contribute $5,000 into your RRSP you can claim that as a deduction and the CRA will give you a tax refund of $1,430.

Who gets an RRSP?

Any Canadian can open an RRSP and begin making contributions but the amount of reported income on your income tax return will effect how much contribution room you have.

How much can I deposit?

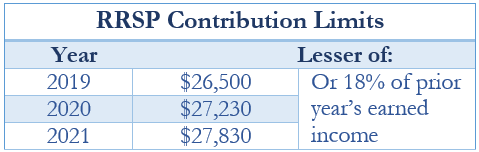

When you file income tax the government gives you a portion of your reported income (18% up to a maximum amount of ~$27,000) as contribution room. If you have ever filed income tax you can check your last “Notice of Assessment” which is available on the CRA “MyAccount” page to see how much contribution room you have.

How do you open an RRSP?

So now that you know what the RRSP is, how do you open one? Pretty much any Canadian bank or investment broker will be able to open a RRSP in your name and you can begin making contributions. Check out this article to compare which institutions are best to open your RRSP.

How to invest in your RRSP?

Picking what to invest in is a deeply personal decision and depends greatly on your own risk tolerance. That being said I have an article here where we review some of the most popular options for investing in a RRSP.

How do you withdraw from a RRSP?

So once you put your money in and have it grow for some amount of time you may end up needing to withdraw the money. Withdrawing from your RRSP unlike the TFSA will have tax implications, this means you may need to pay income tax on the money that you withdraw.